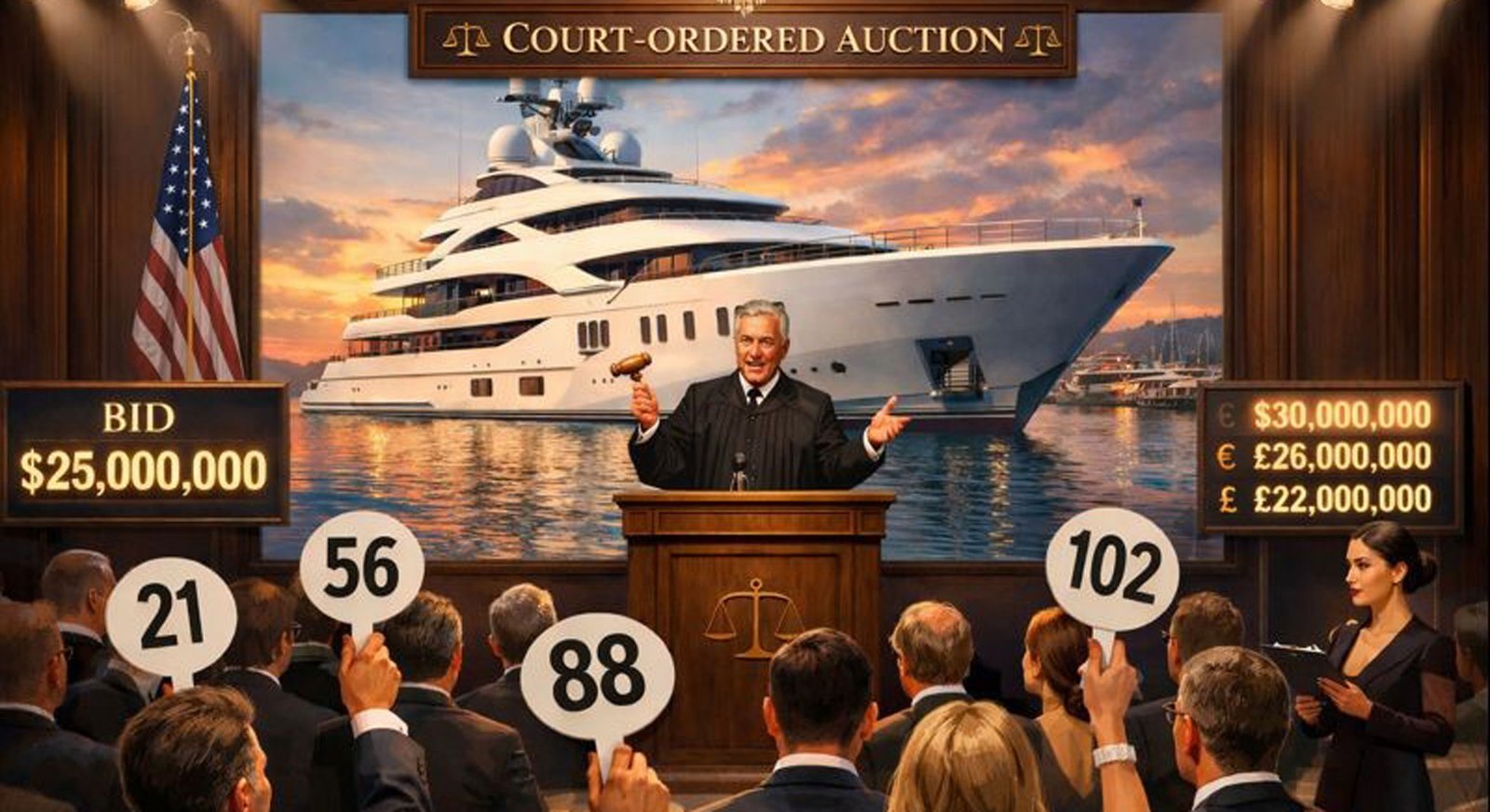

The past few years have pushed judicial yacht sales into the spotlight. Sanctions, unpaid crew wages, and more all feed court-ordered yacht auctions. The headlines sometimes frame them as fire sales, but the truth is more nuanced. The goal is to turn a deteriorating, expensive asset into cash while delivering clean title to a buyer. This requires methodical processes ranging from publishing public notice to transparent bidding. As you’ll learn in this episode of The Yacht Law Podcast, all of these must withstand scrutiny in other jurisdictions. After all, megayachts move, owners change flags, and ultimately challenges can surface anywhere in the world.

The U.S. Marshal sale has become the veritable global gold standard for judicial yacht auctions. Firstly, courts require publication—literal published notice, often at 14 and then seven days in advance. The method of sale varies. Sealed bids are common, for instance, with descending-price formats part of the process in some countries. The one constant, though, is the court seeks fairness and market validation. The Marshal’s Bill of Sale is a powerful instrument to convey title. Foreign courts naturally may ask probing questions like how the auction was run. When notice, the yacht’s value, and procedures are sound, though, they generally respect the sale. In fact, the case of the Blue Star auction in Malta, which we mention in this episode, is a good example of how a proper yacht auction under a judge’s orders is immune to later issues.

All of this said, however, buyers need to understand why judicial yacht auctions take place. Simultaneously, they need to be aware of the scrutiny they themselves face from the court, and the scrutiny the court expects of them. Maritime liens are the leading causative factors behind judicial sales, for instance, and not all are equal. As for the bidding process, in auctions tied to sanctions, enhanced due diligence governs everything. When a price is the equivalent of the bargain of the century, courts treat buyer blindness as a failure. Ignoring warning signs risks losing both the yacht and your money if the sale later unravels due to fraud or procedural defects.

Due diligence extends to digging for details in the absence of a sea trial and survey—two things judicial sales rarely, if ever, permit. Avenues exist to obtain the information you need about maintenance schedules, for example. Additionally, you’re welcome to walk through the yacht and see everything yourself in advance of the yacht auction. Ultimately, it’s important to remember that you’re buying the superyacht as is. It’s not a problem if you gather enough corroborated facts.

Finally, respect the courtroom. Misstatements, bidding to drive up the price, or failing to close can trigger a hammer on your head. The same is true of a broker or someone representing you at a Marshal sale. The lesson is simple: Judicial yacht auctions can deliver real value and globally recognized title, but only to buyers who embrace the process. Hire a maritime lawyer, budget for uncertainty, verify ownership and liens, and know when to walk away. You and the court have one thing in common. You want a yacht that gets sold and stays that way.

Listen to the podcast episode above, or listen and subscribe for free on Apple Podcasts, Spotify, Amazon Music, or your favorite service. Use the link below.

The Yacht Law Podcast theyachtlawpodcast.buzzsprout.com